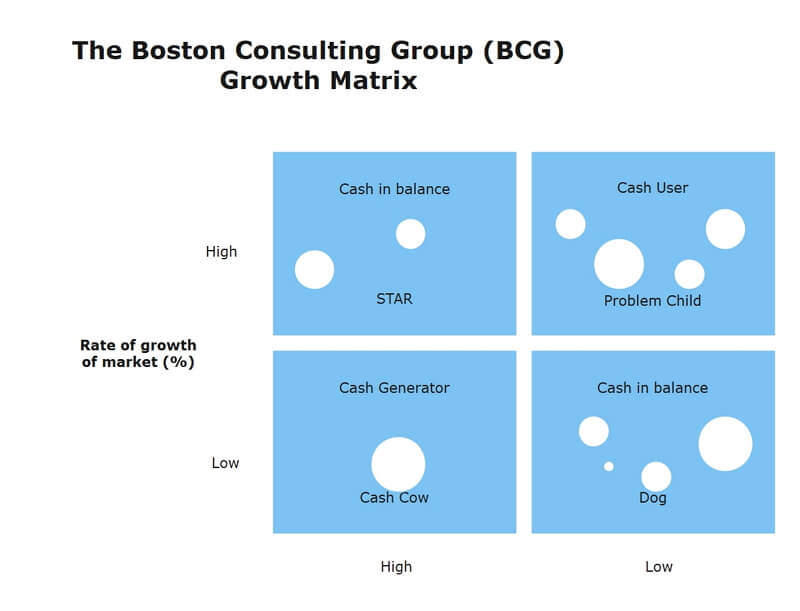

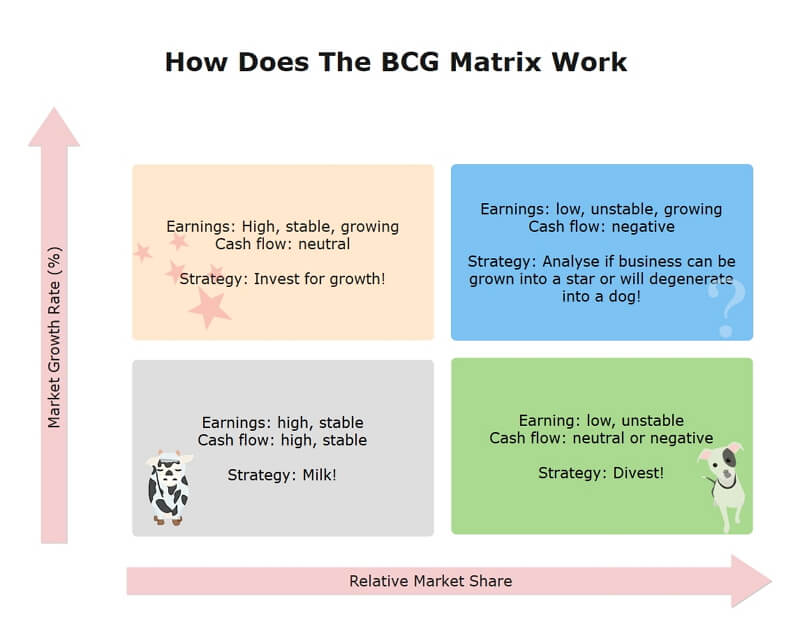

While businesses typically offer a range of products, not all of them generate the same returns. It offers a framework for analyzing the performance of each product, identifying opportunities for growth, and determining where resources should be allocated for the future. What is the BCG matrix (Growth Share Matrix)?Ī BCG matrix is a strategic planning tool used to assess a business's product portfolio. So, let's dive into the world of BCG matrix and learn how to use it to make informed strategic decisions. Additionally, we will provide a practical BCG matrix example of how to create a BCG matrix to help you apply this tool in your own business analysis. In this article, we will discuss the four quadrants of the BCG matrix and their significance, the strategic implications of each quadrant, and how to use BI software to effectively create BCG matrix.

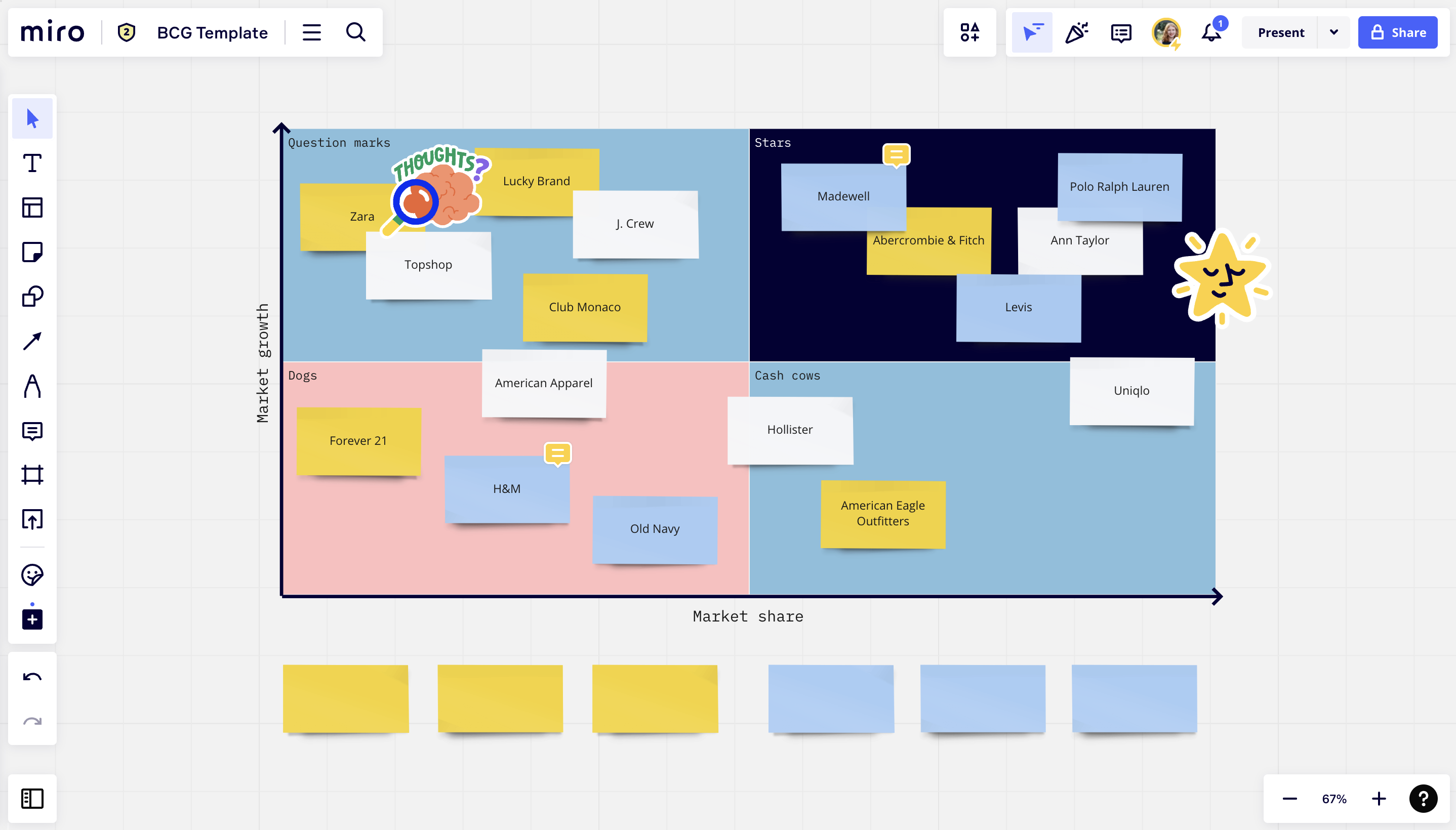

Or you can simply share a diagram edit/ review link with the key people involved.The BCG matrix, also known as the Growth Share matrix, or the Boston Consulting Group matrix, is a simple yet powerful framework used to evaluate a company's product portfolio and determine which products to invest in and which to divest. Export your diagram so you can embed it in your internal websites or the intranet.Invest in the products in the Stars quadrant, consider phasing out the Dogs, milk the Cows and allocate experimental funds for the Question Marks.

Place the units you are analyzing on the appropriate box, based on their market share and growth.This measurement should be plotted on the y-axis.

0 kommentar(er)

0 kommentar(er)